Covid Bill Child Tax Credit Income Limit

It would also extend the credit to 17-year-olds. October 9 2020 Contact.

New Child Tax Credit Explained When Will Monthly Payments Start Wnep Com

New Child Tax Credit Explained When Will Monthly Payments Start Wnep Com

Under the proposed change that person would pay no more than 4950 85 of their income meaning the tax credits would amount to 7950.

Covid bill child tax credit income limit. New 1400 stimulus checks plus a more generous child. Parents making up to 75000 a year 150000 for. Explaining the new child tax credit expansion under the COVID relief bill How much money parents make matters too.

The remaining half of the credit will need to be claimed when filing 2021 tax returns in 2022. House Bill 4571 codifies the state income tax deadline from April 15 to May 17. Income limits put on new child tax credit benefit How much parents make matters too.

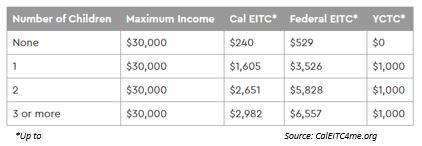

Some economists predict that these payments which will go to all but the wealthiest. The Young Child Tax Credit was introduced in tax year 2019. If the IRS extends the federal income tax filing and payment deadline for the 2020 tax year the state income tax.

Info to know Payments will be divided between 2021 and 2022. Instead of providing families with up to 2000 per child under 17 the government will distribute a total of 3600 for each child under 6 and 3000 for kids under 18. Families with children under 6 will receive a 3600 credit per child while those with school-aged children will receive 3000 per child.

If youve already filed your taxes watch for Internal Revenue. The maximum credit increases for each child with the 2021 tax year payments being 3618 for one child 5980 for two children and 6728 for three or more children. While its been applauded as.

As long as your adjusted gross income also known as AGI is 75000 or less single taxpayer parents will qualify for the full child tax credit amount. If you didnt get a first and second Economic Impact Payment or got less than the full amount you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you dont usually file a tax return. So for a single parent your adjusted gross income needs to.

4 hours agoChild tax credit qualifications and income limits. For each qualifying child age 5 and younger that means up. If youre single you need to make 75000 a year or less to get the full amount.

Newsroomciirsgov SANTA ANA California A Riverside County woman was arrested today on federal charges that she defrauded Californias unemployment insurance system by using stolen personal information obtained from the darknet to fraudulently receive more than a half-million dollars in COVID-19 unemployment benefits. The proposal would make the full Child Tax Credit available to children in families with low earnings or that lack earnings in a year and it would increase the credits maximum amount to 3000 per child and 3600 for children under age 6. The current version of the bill increases the existing child tax credit or CTC to 3600 per child under age 6 and 3000 per child up to 17 years old each year.

Along with boosting the dollar. 112500 for Head of Household. If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit.

This applies to 2020 only. Under prior rules taxpayers could claim a child tax credit of up to 2000 per kid under age 17. You may go back up to four years to claim CalEITC by filing or amending a state income tax return.

2021 Child Tax Credit Income Limit Phaseouts Safe Harbor. The American Rescue Plan raises that to 3600 for kids under age 6 and to 3000 for older. The US19 trillion coronavirus relief package President Joe Biden signed in March 2021 will expand the child tax credit for one year.

The expanded Child Tax Credit is not for everyone with children. The new relief bill will make the first 10200 of benefits tax-free if your income is less than 150000. A new coronavirus relief bill is in the works and it could mean a big payday for some families.

Phaseouts for the increased credit amounts begin at an AGI of.

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

This Year S Child Tax Credit Could Mean Extra Money In Your Pocket By Summer Cbs Pittsburgh

This Year S Child Tax Credit Could Mean Extra Money In Your Pocket By Summer Cbs Pittsburgh

Non Refundable Tax Credit Overview How It Works Example

Non Refundable Tax Credit Overview How It Works Example

3 000 3 600 Child Tax Credit How Many Can I Claim As Com

3 000 3 600 Child Tax Credit How Many Can I Claim As Com

Biden Plan To Expand Child Tax Credit Could Help Lift Millions Of Kids Out Of Poverty Npr

Biden Plan To Expand Child Tax Credit Could Help Lift Millions Of Kids Out Of Poverty Npr

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Biden S Stimulus Plan Would Expand The Child Tax Credit Here S What That Means For You Wluk

Biden S Stimulus Plan Would Expand The Child Tax Credit Here S What That Means For You Wluk

Cnet Child Tax Credit Calculator This Is How Much Money You Ll Get Each Payment Cnet

Cnet Child Tax Credit Calculator This Is How Much Money You Ll Get Each Payment Cnet

Child Tax Credit Who Qualifies For Up To 3 600 In Covid Bill

Child Tax Credit Who Qualifies For Up To 3 600 In Covid Bill

Child Tax Credit Biden Stimulus Plan Could Give Parents 300 A Month Per Child 8news

Child Tax Credit Biden Stimulus Plan Could Give Parents 300 A Month Per Child 8news

Calculating Your Solar Tax Credit 2021 Rec Solar

Calculating Your Solar Tax Credit 2021 Rec Solar

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

Additional Child Tax Credit What Is It Do I Qualify Picnic S Blog

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

Post a Comment for "Covid Bill Child Tax Credit Income Limit"