Covid Relief Bill Child Tax Credit For 2020

The COVID-Related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits for paid sick and family leave under sections 7001-7005 of the Families First Coronavirus Response Act. Featured Credit Cards Banking Investing.

New Child Tax Credit Explained When Will Monthly Payments Start King5 Com

New Child Tax Credit Explained When Will Monthly Payments Start King5 Com

Instead of providing families with up to 2000 per child under 17 the government will distribute a total of 3600 for each child under 6 and 3000 for kids under 18.

Covid relief bill child tax credit for 2020. Will there be a 4th stimulus check. The US19 trillion coronavirus relief package President Joe Biden signed in March 2021 will expand the child tax credit for one year. WASHINGTON President Joe Bidens 19 trillion COVID-19.

WASHINGTON Democrats plan to include an at least 3000-per-child annual tax credit paid to American families monthly in 2021 in the coronavirus relief bill. The enhanced child tax credit passed earlier this year temporarily increases the existing child tax credit from a maximum of 2000 a year per child to 3000 for each child aged 6 to 17 and. Families with children aged 17 and under will receive a credit of 3000 per child.

To check whether someones income qualifies the IRS will look to the most recent tax returns said Karl. That would be 3600 per year. It would also extend the credit to 17-year-olds.

The COVID-19 relief bill gives families up to 3600 per child as a tax credit. The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return. 2020 compared to 2019 or you added a child or dependent on your 2020 tax return.

Families with kids under 6 will receive up to 3600 per child under the new COVID relief bill. Signs 19 trillion Covid relief bill. Business Insider - President Joe Biden told lawmakers that he will put forward a plan to temporarily extend the expanded child tax credit but he stopped short of proposing to permanently install it according to The Wall Street Journal.

The 19 trillion Covid. The proposal would make the full Child Tax Credit available to children in families with low earnings or that lack earnings in a year and it would increase the credits maximum amount to 3000 per child and 3600 for children under age 6. The American Rescue Plan enhanced the child tax credit earned income tax credit and child and dependent care tax credit.

The 19 trillion coronavirus relief package passed Wednesday by the House of Representatives includes a child tax credit of up to 3600 to help families struggling during the. Some economists predict that these payments which will go to all but the wealthiest. The bill would increase the tax break to 3000 for every child age 6 to 17 250 per month and 3600 for every child under the age of 6 300 per month.

Those making up to 200000 individually and 400000 as a couple would still be eligible for the 2000 tax credit that existed before the passage of the COVID relief bill. Under the revised Child Tax Credit the Internal Revenue Service IRS will pay out 3600 per year for each child up to five years old and 3000 per year for each child ages six through 17. For children ages 6-17 the total would drop to 250 per month or 3000 per year.

Over 70 law makers are calling for a fourth stimulus check to be included in Bidens Build Back Better Plan. Families would get the full credit regardless of how little they make in. Liberalized rule for calculating 2020 refundable child credit and earned income tax credit You can collect so-called refundable tax credits even if you have no federal income tax liability.

An expanded child tax credit was included in the 19 trillion COVID-19 relief. The FFCRA passed in March 2020 allows eligible self-employed individuals who due to COVID-19 are unable to work or telework for reasons relating to their own health or to care for a family member to claim refundable tax credits to offset their federal income tax. If this is the case the IRS will send you a.

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

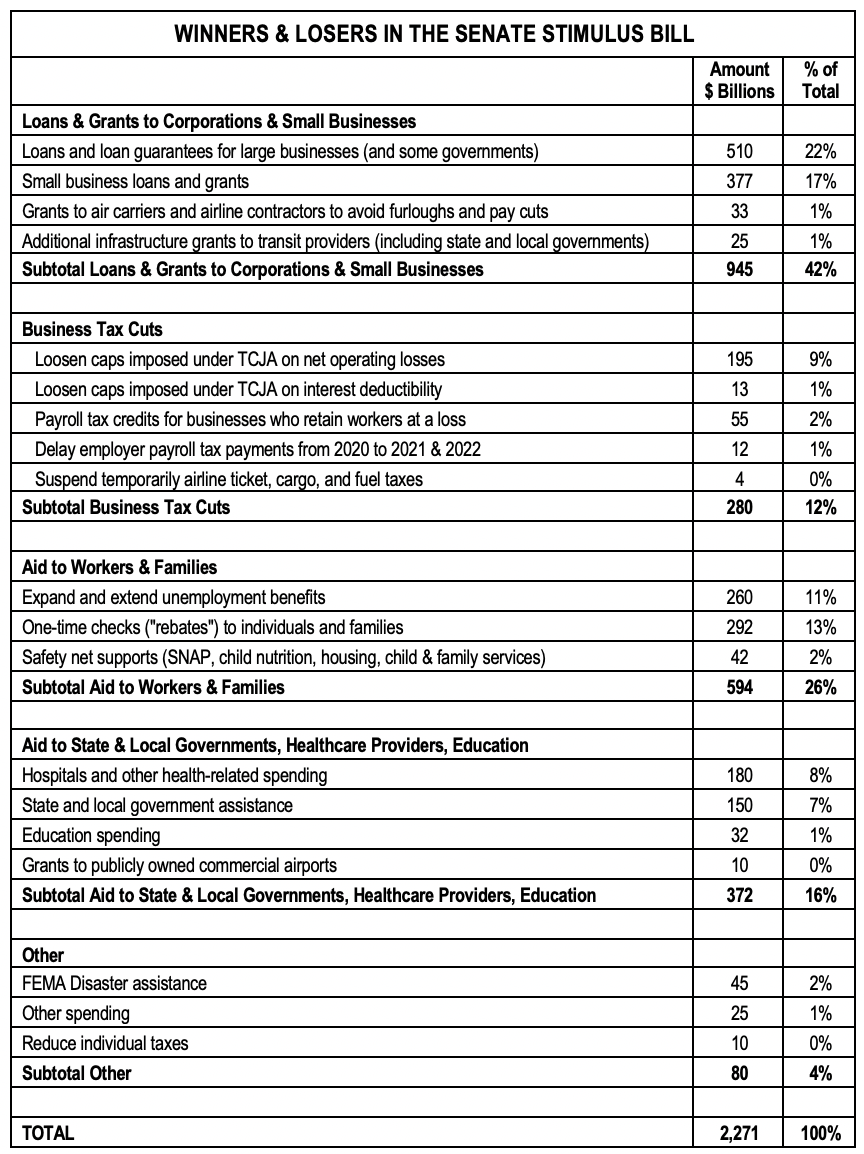

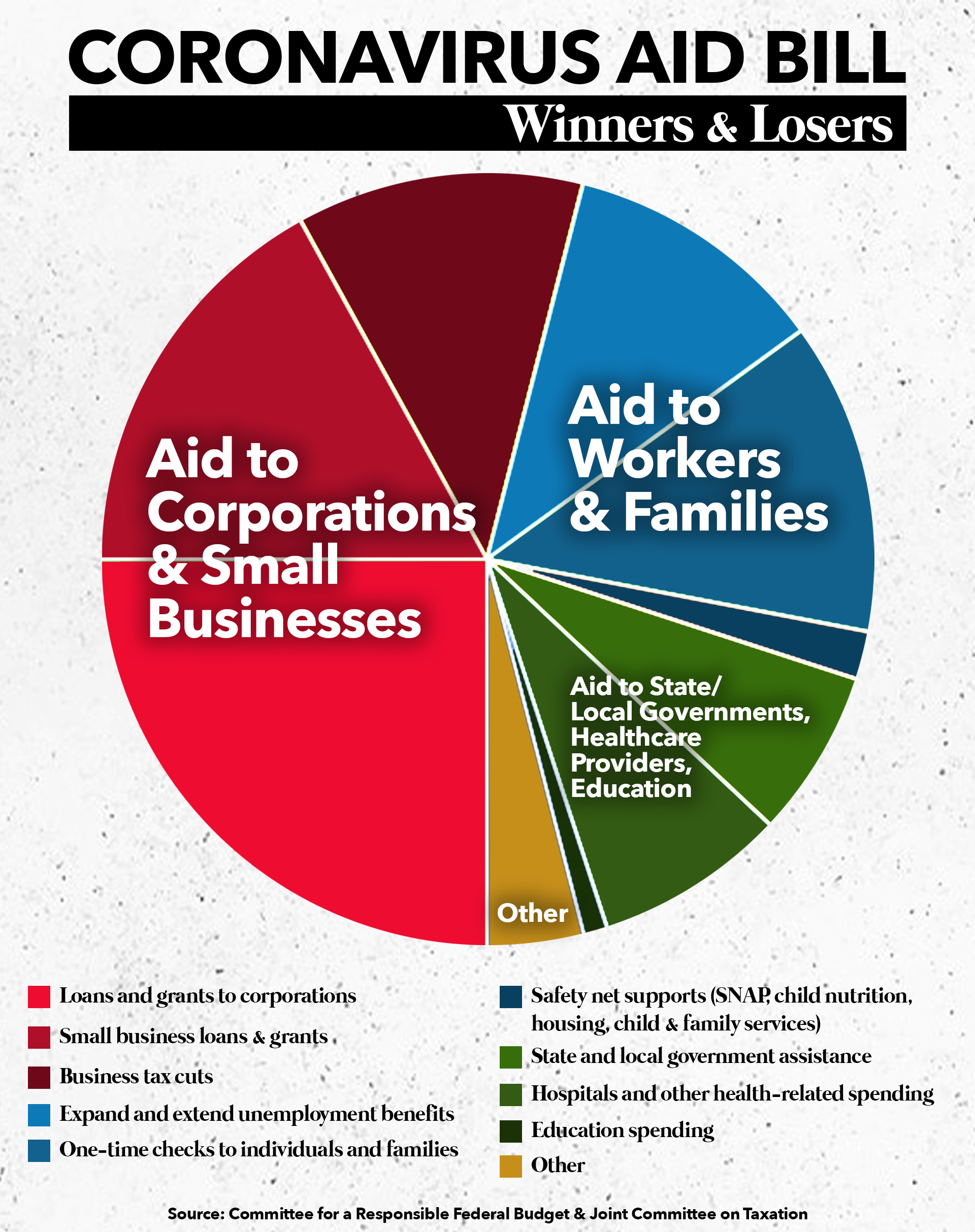

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness

All You Need To Know About Round Two Of Covid Related Stimulus Checks

All You Need To Know About Round Two Of Covid Related Stimulus Checks

New Covid 19 Relief Law Expands Child Tax Credit Provides More Tax Relief Maui Now

New Covid 19 Relief Law Expands Child Tax Credit Provides More Tax Relief Maui Now

Stimulus Bill Details Covid Package Biden Signed Includes 1 400 Checks Child Tax Credit 300 Unemployment Boost Abc11 Raleigh Durham

Stimulus Bill Details Covid Package Biden Signed Includes 1 400 Checks Child Tax Credit 300 Unemployment Boost Abc11 Raleigh Durham

How Will The Child Tax Credit Be Paid Out Answering Your Stimulus Questions 10tv Com

How Will The Child Tax Credit Be Paid Out Answering Your Stimulus Questions 10tv Com

New Child Tax Credit Explained When Will Monthly Payments Start Abc10 Com

New Child Tax Credit Explained When Will Monthly Payments Start Abc10 Com

New Child Tax Credit Expansion Explained 3600 Per Kid 2021 Kcentv Com

New Child Tax Credit Expansion Explained 3600 Per Kid 2021 Kcentv Com

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Expansion Of Community Development Tax Credits Included In Infrastructure Bill Novogradac

Expansion Of Community Development Tax Credits Included In Infrastructure Bill Novogradac

Child Tax Credit Clears Budget Committee Who Would Qualify For Monthly Checks Wreg Com

Child Tax Credit Clears Budget Committee Who Would Qualify For Monthly Checks Wreg Com

Stimulus Checks Tax Credits Paid Leave Who S Getting What In The Covid Relief Bill Wham

Stimulus Checks Tax Credits Paid Leave Who S Getting What In The Covid Relief Bill Wham

Democrats Want To Include 3 600 Child Tax Credit In Covid 19 Relief Proposal Here S Who Qualifies Fox Business

Democrats Want To Include 3 600 Child Tax Credit In Covid 19 Relief Proposal Here S Who Qualifies Fox Business

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Child Tax Credit 2021 Some Families To Receive 300 Stimulus Payment Each Month Per Child 6abc Philadelphia

Child Tax Credit 2021 Some Families To Receive 300 Stimulus Payment Each Month Per Child 6abc Philadelphia

Stimulus Bill Details Covid Package Biden Signed Includes 1 400 Checks Child Tax Credit 300 Unemployment Boost Abc11 Raleigh Durham

Stimulus Bill Details Covid Package Biden Signed Includes 1 400 Checks Child Tax Credit 300 Unemployment Boost Abc11 Raleigh Durham

New Child Tax Credit Expansion Explained 3600 Per Kid 2021 Kcentv Com

New Child Tax Credit Expansion Explained 3600 Per Kid 2021 Kcentv Com

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Post a Comment for "Covid Relief Bill Child Tax Credit For 2020"