Is Child Tax Credit Going Up In 2020

Part of this credit can be refundable so it may give a taxpayer a refund even if they dont owe any tax. For each child between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times in 2021.

For both age groups the rest of.

Is child tax credit going up in 2020. Its a significant increase from the. 1 day agoThe child tax credit got a boost from the American Rescue Plan signed into law by President Joe Biden in March. The 2020 Child Tax Credit Amount.

For both age groups the rest of the payment will come with your 2021 tax. The US19 trillion coronavirus relief package President Joe Biden signed in March 2021 will expand the child tax credit for one year. IRS Tax Tip 2020-28 March 2 2020.

To receive the credit families with children must file a 2020 tax return according to Rettig. The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. Heres everything that changes.

This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. For both age groups the rest of the payment will come with your 2021 tax. What the new child tax credit means for your 2020 taxes Many families can receive up to 3000 or 3600 per child thanks to new changes to the child tax credit.

Taxpayers may be able to claim the child tax credit if they have a qualifying child under the age of 17. The new enhanced credit increases the annual benefit per child. For each child between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times in 2021.

CORONAVIRUS STIMULUS CHECKS. For each child between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times in 2021. Dont forget the child tax credit payments will be split between 2021 and 2022 The first thing to know is you wont get your child tax credit payments all at once this year.

The IRS will start sending monthly payments from the new 3000 child tax credit in July to families who have proven eligibility by filing a 2020 tax return. For 2020 returns the ACTC is worth up to 1400. As with your taxes.

This is up from the prior 1000 amounts. The legislation increases the tax credit from 2000 to a maximum of 3600 and expands eligibility to families who make no or very little income each year. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6.

Will the IRS send supplemental payments to 2020 tax filers. For the 2020 tax year the Child and Dependent Care Credit can get you 20 to 35 of up to 3000 of child care and similar costs for a child under 13. With tax reform the Child Tax Credit was increased to 2000 per qualifying child and will be refundable up to 1400 subject to income phaseouts.

The credit would also. The taxpayers qualifying child must have a Social Security number issued by the Social Security Administration before the due date of their tax return. Some economists predict that these payments which will go to all but the wealthiest.

If a family doesnt file a 2020 return the agency will not have the information it needs to deliver. And previously the Child Tax Credit was only refundable if you filed for the Additional Child Tax Credit. The Additional Child Tax Credit or ACTC is a refundable credit that you may receive if your Child Tax Credit is greater than the total amount of income taxes you owe as long as you had an earned income of at least 2500.

Instead of providing families with up to 2000 per child under 17 the government will distribute a total of 3600 for each child under 6 and 3000 for kids under 18. For 2020 the maximum amount of the credit is 2000 per qualifying child. The tax authority is committed to completing all plus-up payments by the end of the year.

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Child Tax Credit For 3 000 Or More When The First Payment May Arrive Overpayments Other Details Cnet

Child Tax Credit For 3 000 Or More When The First Payment May Arrive Overpayments Other Details Cnet

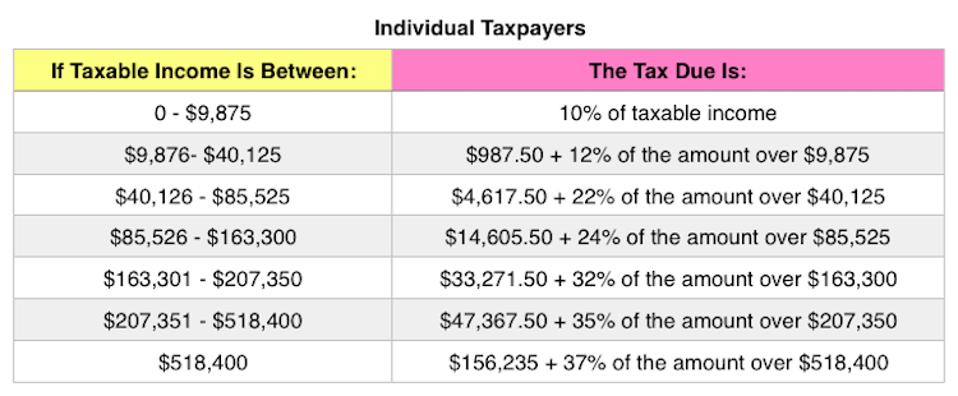

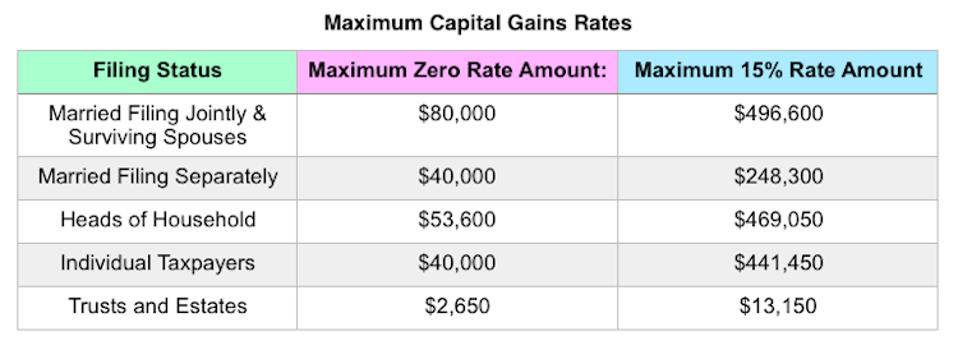

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Child Tax Credit 2021 Monthly Payments Starting In July Here S What To Know Cnet

Child Tax Credit 2021 Monthly Payments Starting In July Here S What To Know Cnet

Who S Qualified For The Child Tax Credit 2021 Income Rules And More Cnet

Who S Qualified For The Child Tax Credit 2021 Income Rules And More Cnet

Child Tax Credit 2021 Who Gets 3 600 Will I Get Monthly Payments And Other Faqs Nasdaq

Child Tax Credit 2021 Who Gets 3 600 Will I Get Monthly Payments And Other Faqs Nasdaq

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

Do You Qualify For The New Child Tax Credit 2021 Income Limits And More Details Cnet

Do You Qualify For The New Child Tax Credit 2021 Income Limits And More Details Cnet

Cnet Child Tax Credit Calculator This Is How Much Money You Ll Get Each Payment Cnet

Cnet Child Tax Credit Calculator This Is How Much Money You Ll Get Each Payment Cnet

Post a Comment for "Is Child Tax Credit Going Up In 2020"