How To Determine Child Tax Credit Amount

The credit is worth up to 2000 per dependent for tax years 2020 and 2021 but your income level determines exactly much you can get. April 13 2021.

Http Childtaxcredit001 Jigsy Com Entries General Child Tax Credit Return Child Tax Credit Tax Credits Dashboard App

Http Childtaxcredit001 Jigsy Com Entries General Child Tax Credit Return Child Tax Credit Tax Credits Dashboard App

Child Tax Credit Qualifying for the Child Tax Credit.

How to determine child tax credit amount. Families with older kids are also eligible. The recent Tax Cuts and Jobs Act TCJA also dramatically increased the income limits so now most families in America with qualifying children will have the chance to claim this credit. The fastest and most accurate way for you is to file is electronically where the tax software will help you figure your Recovery Rebate Credit.

Standard Child Tax Credit The Martins would receive a check for some of the CTC left after paying taxes but lose 1300 that could be used only. Worksheet for Calculating How Much Child Tax Credit You Can Claim You must determine how many qualifying children you can claim based on the six tests mentioned above. The Child Tax Credit is intended to offset the many expenses of raising children.

You can claim 500 for each child aged 17 and 18 or for full-time. The child credit is a credit that can reduce your Federal tax bill by up to 2000 for every qualifying child. In addition the Child Tax Credit is limited by the amount of the income tax you owe as well as any alternative minimum tax you owe.

Then it phases out for income above 200000 for single filers and 400000 for joint filers. Determine your modified. Multiply the number of dependent children you can claim by 2000 maximum amount of the Child Tax Credit.

Calculating the amount of the Child Tax Credit requires a few key numbers. The credit begins to phase out when adjusted gross income reaches 75000 for single filers 150000. Determining the Child Tax Credit amount.

Determining the refundable Additional. What is the Child Tax Credit. However unless they opt out of the monthly payments most people will get the.

Families with children aged 17 and under will receive a credit of 3000 per child. If the amount of the credit you can claim is 2000 but the amount of your income tax liability is 400 the credit ordinarily will be limited to 1600 2000 - 400. The American Rescue Plan Act which President Biden signed into law on March 11 temporarily increases the child tax credit from 2000 to 3000 per child.

The Child Tax Credit can be worth as much as 2000 per child for Tax Years 2018-2025. To qualify for the Child Tax Credit you have to include the name and Social. The tax credit is not a deduction so if you claim the full 2000.

The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040-SR instructions can also help determine if you are eligible for the credit. For starters families who qualify for the child tax credit will get up to 500 3000 or 3600 per child total. The child tax credit CTC is changing for the 2021 tax year and the amount that qualifying families can receive per child has been significantly increased from 2000 to up to 3600.

You need to have earned at least 2500 to qualify for the CTC. The Child Tax Credit is a refundable tax credit of up to 3600 per qualifying child under 18. For Tax Years 2018-2025 the maximum refundable portion of the credit is 1400 equal to 15 of earned income above 2500.

Solar Investment Tax Credit Explained Energysage Tax Credits Investing Solar

Solar Investment Tax Credit Explained Energysage Tax Credits Investing Solar

Small Business Tax Credit Calculator Small Business Tax Tax Credits Business Tax

Small Business Tax Credit Calculator Small Business Tax Tax Credits Business Tax

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Here S How The New Child Tax Credit Payments Will Work Forbes Advisor

Monthly Child Tax Credit Check For 500 3 000 Or 3 600 Total Per Kid Here S What You Ll Get Cnet

Monthly Child Tax Credit Check For 500 3 000 Or 3 600 Total Per Kid Here S What You Ll Get Cnet

Https Apps Irs Gov App Vita Content Globalmedia 4491 Child Tax Credit Pdf

How To Use The Irs Withholding Calculator Child Tax Credit Budgeting Tips Budgeting

How To Use The Irs Withholding Calculator Child Tax Credit Budgeting Tips Budgeting

Child Tax Credit For 3 000 Or More When The First Payment May Arrive Overpayments Other Details Cnet

Child Tax Credit For 3 000 Or More When The First Payment May Arrive Overpayments Other Details Cnet

.png) The Tax Benefits Of Having An Additional Child Tax Foundation

The Tax Benefits Of Having An Additional Child Tax Foundation

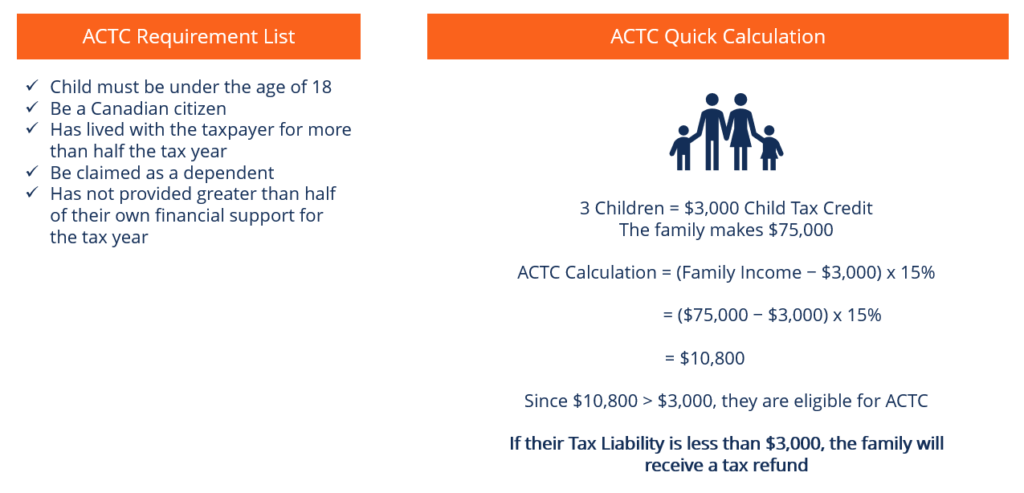

Additional Child Tax Credit Actc Overview How It Works Requirement

Additional Child Tax Credit Actc Overview How It Works Requirement

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

What Qualifies A Dependent For The Child Tax Credit 2021 It S Complicated Cnet

The Tax Benefits Of Having An Additional Child Tax Foundation

The Tax Benefits Of Having An Additional Child Tax Foundation

What Is The Earned Income Tax Credit Credit Table Tax Credits Income Tax Income

What Is The Earned Income Tax Credit Credit Table Tax Credits Income Tax Income

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax

Access Denied Credit Score What Is Credit Score Tax Credits

Access Denied Credit Score What Is Credit Score Tax Credits

Who S Qualified For The Child Tax Credit 2021 Income Rules And More Cnet

Who S Qualified For The Child Tax Credit 2021 Income Rules And More Cnet

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Irs Website

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Irs Website

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Post a Comment for "How To Determine Child Tax Credit Amount"