How To Get Rid Of Student Loans During Coronavirus

You can contact your student loan servicer to inquire about potential payment options due to Coronavirus. Above Coastline College staff distribute computers to students who.

Don T Get Excited About Joe Biden Canceling Student Loan Debt Just Yet Forbes Advisor

Don T Get Excited About Joe Biden Canceling Student Loan Debt Just Yet Forbes Advisor

The COVID-19 health and economic emergency has caused temporary financial hardship for many Americans making it difficult for many federal student loan.

How to get rid of student loans during coronavirus. How to Get Student Loan Relief During COVID-19 and Beyond. Some student loans get payment relief under the coronavirus stimulus package. The federal Coronavirus Aid Relief and Economic Security CARES Act brought some much-needed financial relief for Americans including specific provisions for people with federal student loans.

Ryan Lane Anna Helhoski April 8. The interest rate on all US. After the payment suspension ends rehabilitation payments must be received within 20 days of the due date to be.

After that defaults are likely to return to pre-pandemic levels. Laurel Road private student loan borrowers who are financially impacted by the coronavirus may be eligible for a forbearance of three payments. You need to make nine on-time monthly payments or payment credits in order to successfully complete loan rehabilitation.

This legislation would extend the relief provided for federal borrowers in the Coronavirus Aid Relief and Economic Security Cares Act. Department of Education ED held student loans serviced by FedLoan Servicing have been temporarily reduced to 0 through at least September 30 2021. Learn about the payment suspension and its impact on loans in default.

The original coronavirus relief bill known as the CARES Act and signed into law on March 27 2020 helped most federal student loan borrowers by temporarily pausing payments. As a result of the COVID-19 pandemic the government paused interest charges and payments for most federal student loans but this temporary relief is set to expire at the end of September 2021. If you lose your job or have lower income due to COVID-19 you can re-certify your income to recalculate your monthly payment through an.

Many student loan lenders have similar forbearance and deferment options as the federal. During the COVID-19 emergency relief period suspended payments count toward loan rehabilitation. Before the pandemic borrowers were defaulting on federal student loans every 26 seconds or just over 12 million times.

0 Interest for Student Loans. The feds states and even private lenders are offering relief for student loan borrowers. FedLoan Servicing has automatically adjusted accounts so that interest doesnt accrue ie accumulate.

6 Ways To Stop Student Loan Wage Garnishment Student Loan Hero

6 Ways To Stop Student Loan Wage Garnishment Student Loan Hero

Private Loans Student Loan Borrowers Assistance

Private Loans Student Loan Borrowers Assistance

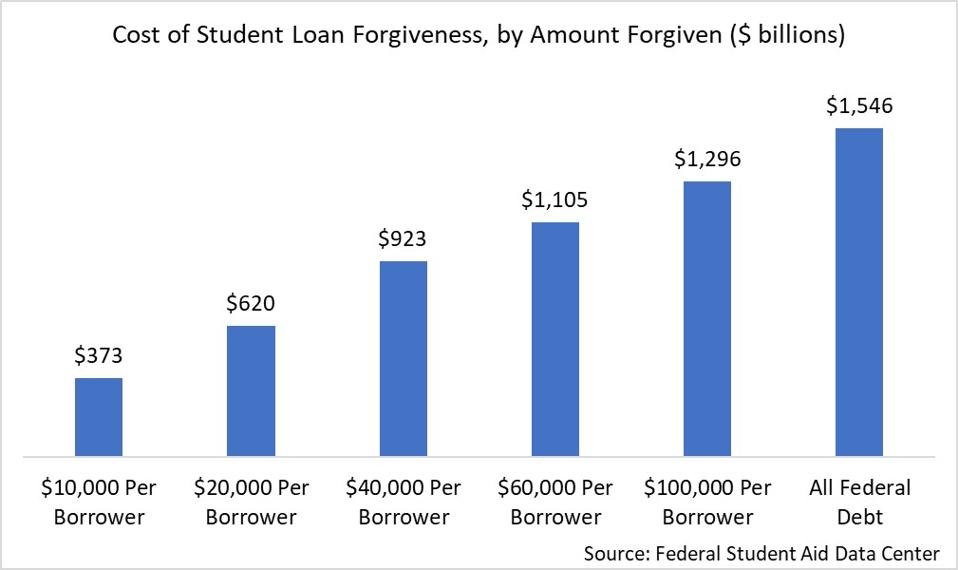

Policy Options For Student Loan Forgiveness

Policy Options For Student Loan Forgiveness

Extending Student Loan Relief During The Coronavirus Pandemic Urban Institute

Extending Student Loan Relief During The Coronavirus Pandemic Urban Institute

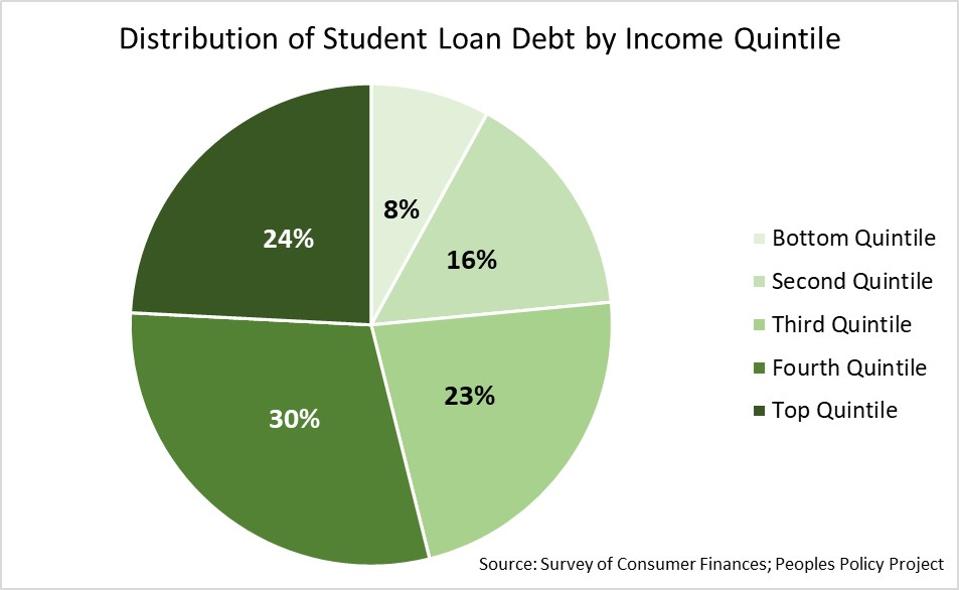

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Managing Your Student Loans During Covid 19

Managing Your Student Loans During Covid 19

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Find Solutions To Get Out Of Student Loan Debt Debt Com

Find Solutions To Get Out Of Student Loan Debt Debt Com

Here S How To Get Coronavirus Student Loan Relief

Here S How To Get Coronavirus Student Loan Relief

Paying Student Loan Debt Modification Repayment Options

Paying Student Loan Debt Modification Repayment Options

Strategies To Pay Off Student Loan Debt Faster Experian Global News Blog

The Case Against Student Loan Forgiveness

The Case Against Student Loan Forgiveness

Best Student Loans Of 2020 Money S Top Picks

Best Student Loans Of 2020 Money S Top Picks

Tips For Paying Off 200k In Student Loans Without Losing Your Mind Student Loan Hero

Tips For Paying Off 200k In Student Loans Without Losing Your Mind Student Loan Hero

Will Joe Biden Deliver On His Promises To Alleviate Student Loan Debt News The Harvard Crimson

Will Joe Biden Deliver On His Promises To Alleviate Student Loan Debt News The Harvard Crimson

What To Know About The Debate Over Student Loan Forgiveness Npr

What To Know About The Debate Over Student Loan Forgiveness Npr

What The New Stimulus Package Means For Student Loan Forgiveness Forbes Advisor

What The New Stimulus Package Means For Student Loan Forgiveness Forbes Advisor

Aoc Insists Biden Can Use Executive Order To Cancel Student Loan Debt Fox Business

How To Handle Biden S Disappointing Student Loan Forgiveness Plan

How To Handle Biden S Disappointing Student Loan Forgiveness Plan

Post a Comment for "How To Get Rid Of Student Loans During Coronavirus"